Archive

Categories

Categories

Recent Posts

3/recent/post-list

Tags

Random Posts

3/random/post-list

Popular Posts

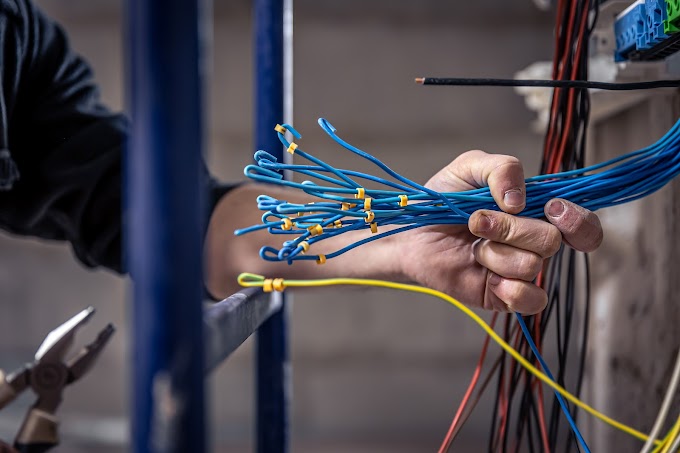

How Much Does It Cost to Rewire a House in 2023?

September 17, 2023

Travel Insurance: Protecting Your Adventures

July 11, 2023

In today's fast-paced world, education stands as a cornerstone of individual growth and societal progress. The United States boasts an array of prestigious universities that have set global standards for academic excellence, research, and innovation. This article delves into the top 5 universities in the country, shedding light on their distinct features and contributions to higher education. Criteria for Ranking Universities Before exploring the universities themselves, it's crucial to understand the criteria that underpin their rankings. These institutions are evaluated based on a range of factors, including academic reputation, faculty expertise, research output, student-faculty ratio, diversity, and campus facilities. This comprehensive approach ensures that the rankings reflect a holistic view of an institution's impact on the educational landscape. Harvard University: A Legacy of Excellence Harvard University , established in 1636, stands as a testament to centuries o...

Online Degree Programmes: What You Need to Know

Published by

HiiHELLO

On

Online Degree Programmes: What You Need to Know Are you looking for a way to advance your education and career without compromising your personal or professional commitments? Do you want to learn from some of the best teachers in the world at your own pace and convenience? Do you want to access a wide range of courses and programs that suit your interests and goals? If you answered yes to any of these questions, then you might want to consider enrolling in an online degree programme. Online degree programmes are courses or programs that are delivered entirely or partially through the internet. They allow students to earn academic credentials such as diplomas, certificates, bachelor's degrees, master's degrees, or doctoral degrees from accredited institutions without having to attend physical classes or campuses. Online degree programmes are becoming increasingly popular among students who want to pursue higher education while balancing their work, family, and other responsibili...

Your Money, Your Way: How to Choose the Best Online Banking App for Your Financial Goals!

Published by

HiiHELLO

On

Online banking apps have revolutionized the way people manage their finances and conduct transactions. With the advancement of technology, banking has become more convenient, accessible, and secure than ever before. In this article, we will explore some of the most popular online banking apps available in India and their unique features. Specifically, we will delve into Yono SBI, Google Pay, Paytm, and PhonePe, highlighting their functionalities, benefits, and comparative analysis. The Rise of Online Banking Apps Over the past decade, the proliferation of smartphones and the widespread availability of the internet have given rise to a digital transformation in the banking industry. Traditional banking methods have gradually been replaced by online banking apps, enabling users to perform a wide range of financial activities at their fingertips. These apps have gained immense popularity due to their ease of use, convenience, and time-saving capabilities. Benefits of Online Banking Apps C...